Published by: WIPO Magazine

The following is a collection of excerpts from this article written by James Nurton

The worldwide value of intangible assets grew from USD 61 trillion in 2019 to USD 74 trillion in 2021, according to the Brand Finance Global Intangible Finance Tracker. In addition, Ocean Tomo research has found that intangible assets account for 90 percent of the value of S&P 500 companies. Yet many intellectual property (IP)-rich companies, particularly start-ups and small and medium-sized enterprises (SMEs), struggle to secure financing. Why? One reason is investors find it hard to value and analyze intangible assets (e.g. know-how and data) compared to physical (tangible) assets such as real estate, machinery and stock.

BDC Capital’s approach

BDC Capital’s CAD 160 million (USD 119 million) IP development financing envelope, the first of its kind in Canada, was launched in July 2020, to provide funding of between CAD 3 million and CAD 10 million to Canadian companies. Since launch the fund has received some 1,500 applications – and has closed 15 deals…

What investors want to know

A priority for IP-backed financing is what Rementilla calls “clear alignment between the business and IP strategies.” This means that companies must be able to show what IP assets they have (including details of IP filings and grants), how these relate to their core products and services and revenue streams, and why they have a unique value proposition in their market. “Some companies aren’t prepared for that,” she says.

To secure financing, companies must be able to demonstrate their unique selling proposition in their market, and become a leading company in their sector globally – preferably with relevant data. Rementilla adds that BDC Capital does not take on technology risk, so companies must already be at, or close to, the stage of commercializing their innovation.

Those seeking funding should also be open to input from the investors. Rementilla says IP valuation evolves with technological progress and its commercialization. For this reason, BDC Capital continues to monitor IP portfolios over time, and typically seeks reporting twice a year. This monitoring can lead to valuations being updated. More importantly, it can also lead to new insights, as each portfolio is reviewed in response to questions, such as: Are more prior art searches needed? Does the IP landscape need to be scanned more frequently? Is the understanding of competitors’ positions up to date? And are there new opportunities for technology licensing or mergers and acquisitions?

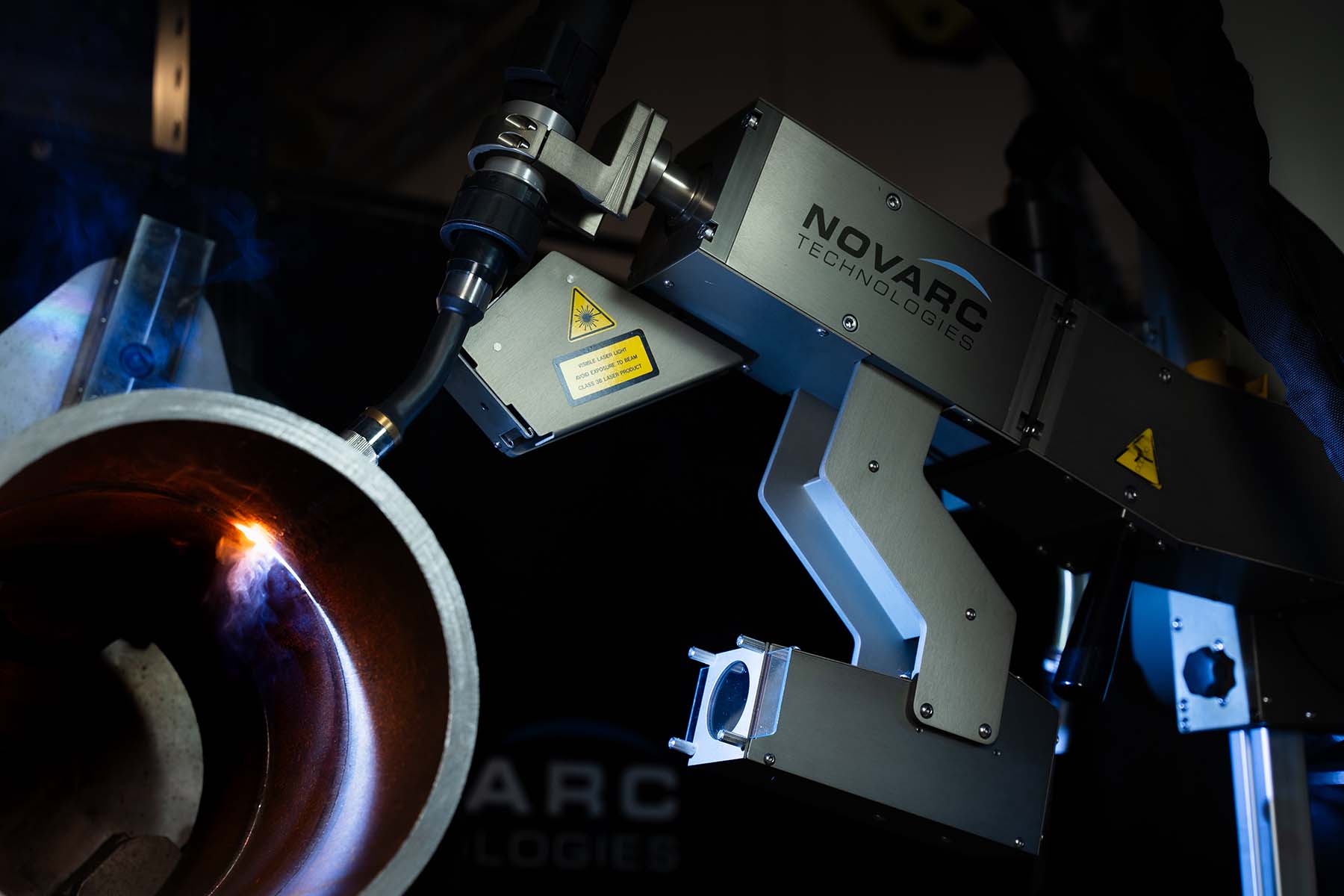

When it comes to investing, BDC Capital is technology agnostic. Its first 15 deals have spanned a range of Canadian companies, though the most popular sectors have been healthcare, sustainability and enterprise solutions. One of its most successful deals, with a Vancouver-based robotics company called Novarc Technologies, was the very first to be announced.

IP financing can catalyze additional investment

Novarc specializes in designing and commercializing collaborative robots (known as cobots) for industry, in particular welding. Founded in 2013, it grew by 1,235 percent from 2016 to 2019 and was ranked 45th among Canada’s Top Growing Companies in 2020. It has expanded from North America to Asia, Europe and the Middle East.

One of Novarc’s strengths is using AI and robotics to provide automated solutions to help welders in pipe fabrication shops – something that is becoming essential due to the looming global shortage of welders. Since early in its development, Novarc has focused on protecting its IP and intangible assets, including through patenting.

In February 2021, BDC Capital announced that it had provided Novarc with CAD 2.6 million in growth capital. The company’s CEO and co-founder, Soroush Karimzadeh, said at the time of the announcement that the IP fund “is a unique non-dilutive product that we were missing in the financing ecosystem in Canada, which can help bridge seed/strategic investment rounds to profitability.”

Rementilla says that BDC Capital’s analysis clearly showed that Novarc’s IP portfolio “gave the company differentiation in the market.” It also had a powerful software platform and the ability to collect data about how welders approach different types of welding jobs – giving it an important competitive advantage in developing future algorithms and products…